Kaia Gao

Leanid Palhouski

Product explainer

—

Jan 7, 2026

Credit card terms change often, but websites and AI answers lag behind. Wrodium fixes this by turning every APR, fee, and disclosure into a tracked, verifiable claim that updates when sources change. The result is compliant, AI-visible credit card content that stays accurate across websites, search, and chatbots.

Introduction

Credit card information changes constantly. APRs adjust, fees shift, rewards update, and regulatory thresholds move with inflation. Yet many pages and AI answers still cite old facts, which misleads consumers and creates compliance risk for brands.

At the same time, AI-first search now answers questions directly. When that happens, users may never visit your site. Leaders in personal finance have publicly noted declining clicks as AI summaries expand across queries. For credit card enterprises, accuracy and AI visibility are now inseparable.

This article explains how Wrodium addresses both problems by converting static pages into a living knowledge layer. You will see how claims are tracked, how regulatory updates are detected, and how structured data improves AI discoverability without sacrificing auditability.

Core Concepts: Why Accuracy Breaks Down

Credit card content fails for three structural reasons:

Static publishing models: CMS workflows focus on creating pages, not maintaining facts over time.

Regulatory drift: Fees, thresholds, and disclosures change on fixed schedules or via rulemaking.

AI reuse of stale content: Large language models retrieve contextually relevant text without checking freshness.

Table 1. Common sources of credit card misinformation

Source of error | What changes | Typical impact |

|---|---|---|

Rate updates | APRs, intro periods | Mispriced offers |

Fee adjustments | Annual, penalty, disclosure fees | Compliance exposure |

Rewards revisions | Earn rates, caps | Customer dissatisfaction |

Regulatory thresholds | Exemptions, limits | Incorrect disclosures |

These gaps explain why finance answers generated by AI are frequently misleading or incorrect, often due to outdated data.

Why AI Search Makes Fresh Data Critical

AI search systems do not filter by publication date. An article from 2019 can still rank if the wording matches the question. When terms change, AI may present conflicting answers without signaling which is current.

Independent testing found AI overviews contained incorrect information 12 percent of the time and misleading information another 31 percent, largely because products and services had changed since publication. In credit cards, that can mean quoting a defunct bonus or the wrong fee.

Consumers increasingly rely on AI for financial information. Recent industry analysis shows roughly 60 percent of U.S. adults now use AI search tools for finance questions. If your brand is absent or misrepresented in those answers, visibility drops even if traditional SEO is strong.

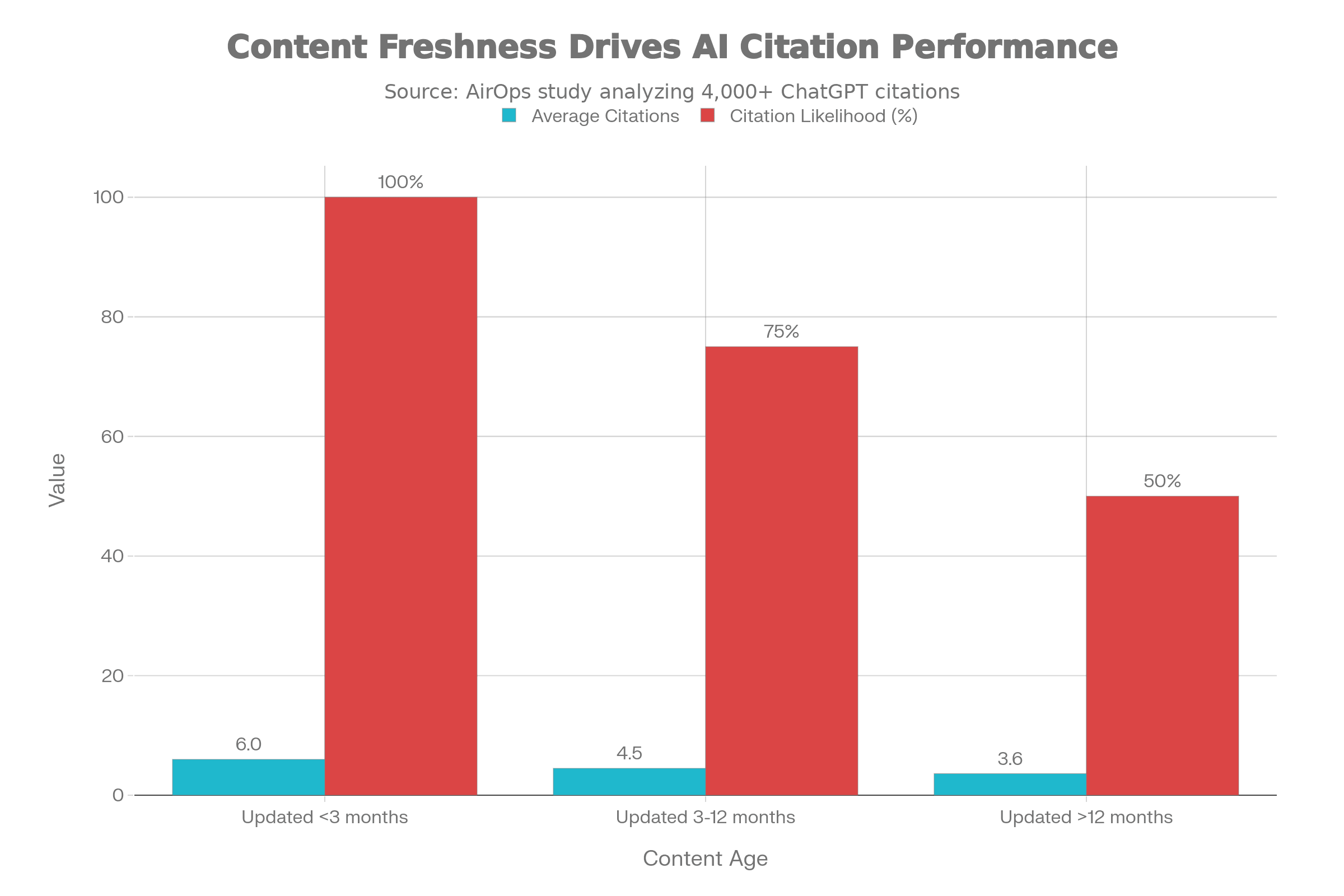

Source: AirOps. Content freshness dramatically affects AI citation rates. Pages not updated within 12 months are 50% less likely to be cited and receive 40% fewer citations on average

Wrodium’s Approach: A Living Layer of Truth

Wrodium replaces static copy with a governed knowledge layer. Each factual statement is treated as a claim, defined as a discrete, verifiable assertion such as an APR, fee, reward rate, or eligibility threshold.

For every claim, Wrodium stores:

The approved value.

The authoritative source.

A timestamp and change history.

Wrodium then monitors those sources. When a value changes, editors are alerted with the new verified data.

Example

If a card’s introductory APR period extends from 12 to 18 months, Wrodium detects the update in the source data and flags every page and FAQ referencing the old period. Editors approve once, and the change propagates everywhere.

This creates a single source of truth across websites, documentation, FAQs, and chatbot scripts.

Regulatory Monitoring in Practice

Financial regulations change on predictable schedules, but content often does not.

Two recent examples illustrate the risk:

The Consumer Financial Protection Bureau increased the Fair Credit Reporting Act disclosure fee cap to $16 effective 2026.

Regulation Z exempt-credit thresholds rose to $73,400 for 2026 after inflation indexing.

Any page still quoting the prior figures is now incorrect.

Table 2. How Wrodium handles regulatory change

Step | Action | Outcome |

|---|---|---|

Detect | Monitor regulator updates | Early awareness |

Flag | Identify affected claims | Precise impact |

Review | Editorial approval | Human oversight |

Propagate | Update all instances | Consistency |

Wrodium does not replace compliance review. It ensures approved claims stay current and consistent after approval.

Structured Data and AI Visibility

Accuracy alone is not enough. AI systems also need clear signals to understand and trust your content.

Wrodium operationalizes structured data as part of governance. It supports Schema.org types commonly used for credit cards, including FinancialProduct, Organization, and FAQ markup.

Google has stated that structured data underpins how AI systems interpret and surface information. Audit frameworks for AI trust further recommend consistent brand identifiers and entity relationships to strengthen credibility.

Table 3. Structured data benefits for credit card content

Element | Purpose | AI benefit |

|---|---|---|

FinancialProduct | Defines card attributes | Clear extraction |

Organization | Verifies issuer identity | Trust signal |

FAQ markup | Clarifies common questions | Direct answers |

Industry research shows that brands cited in AI answers gain visibility even when users do not click through. Wrodium aligns freshness, structure, and sourcing to improve those citations.

Compliance, Knowledge Graphs, and Accountability

Regulated finance requires traceability. Auditors ask what was said, when it was said, and why it was believed to be true.

Wrodium’s model mirrors knowledge graph approaches used in fintech, where entities and facts are linked with clear lineage. Each credit card claim is connected to its source document, creating an auditable trail.

Organizations using knowledge graph techniques report significantly faster compliance reporting because data lineage is explicit. Wrodium applies that discipline to customer-facing content.

From the Field

In our reviews of large card portfolios, we often found the same APR listed three different ways across a site. Editors knew updates were needed, but lacked a map of where facts lived. Once claims were centralized, updates took minutes instead of weeks, and compliance teams finally had confidence that public content matched approved terms.

Example Workflow for a Large Card Issuer

A national bank manages dozens of cards with frequent updates.

Wrodium extracts all factual claims from existing content.

Each claim is linked to an internal system or regulatory source.

Continuous monitoring detects rate, fee, or rule changes.

Editors approve updates once.

All connected content updates automatically.

Marketing teams can also see where their cards appear in AI answers. If visibility is low, they enrich claims with clearer sources or structured data, a factor shown to influence AI inclusion.

Practical Checklist: Keeping Credit Card Content Current

Use this checklist to evaluate your current approach:

Track every APR, fee, and threshold as a discrete claim.

Attach authoritative sources and timestamps.

Monitor regulatory and product updates continuously.

Require human approval before propagation.

Use structured data consistently across pages.

Audit AI citations, not just rankings.

Pros and Cons of a Claim-Based Model

Table 4. Evaluating Wrodium’s approach

Aspect | Benefit | Trade-off |

|---|---|---|

Accuracy | Fewer outdated facts | Setup effort |

Compliance | Clear audit trails | Requires discipline |

AI visibility | Better citations | Needs schema literacy |

Efficiency | Faster updates | Process change |

FAQs

How is Wrodium different from a CMS?

A CMS manages pages. Wrodium manages facts within those pages, ensuring they stay current over time.

Does Wrodium replace legal or compliance review?

No. It supports compliance by flagging changes, but final approval remains with your teams.

Can Wrodium help with AI answers like ChatGPT or Gemini?

Yes. By keeping facts current and structured, it improves the likelihood that AI systems cite accurate information.

What types of sources does Wrodium monitor?

Regulators, official issuer data, and approved internal systems. Sources are configurable.

Is this only for credit cards?

No. It works best for any fact-dense, regulated content, but credit cards are a strong fit.

Conclusion and Next Steps

Credit card content cannot be treated as static copy in an AI-first world. Outdated facts erode trust, invite compliance risk, and reduce visibility in the very channels consumers now use most.

Wrodium closes that gap by transforming facts into living, auditable claims that update as reality changes. If you are responsible for credit card content, the next step is simple: inventory your claims, identify where drift occurs, and evaluate whether a governed knowledge layer could reduce risk while improving reach.

Updated January 7, 2026

References

Search Engine Journal, “Google’s AI Fails at 43% of Finance Queries,” 2025. https://www.searchenginejournal.com/googles-ai-fails-at-43-of-finance-queries-study-finds/530542/

The College Investor, “37% of Google AI Finance Answers Are Inaccurate in 2025,” 2025. https://thecollegeinvestor.com/66208/37-of-google-ai-finance-answers-are-inaccurate-in-2025/

deBanked, “NerdWallet: AI Answers Are Taking Organic Search Clicks Away,” 2025. https://debanked.com/2025/08/nerdwallet-ai-answers-are-taking-organic-search-clicks-away/

Mondaq, “CFPB Finalizes 2026 Increase to FCRA Disclosure Fee Cap,” 2025. https://www.mondaq.com/unitedstates/financial-services/1723574/cfpb-finalizes-2026-increase-to-fair-credit-reporting-act-disclosure-fee-cap

Consumer Financial Protection Bureau, “Truth in Lending (Regulation Z) Threshold Adjustments,” 2025. https://www.consumerfinance.gov/rules-policy/final-rules/truth-lending-regulation-z-threshold-adjustments/

Wellows, “AI Search Visibility for Banking and Financial Services Brands 2026,” 2026. https://wellows.com/blog/ai-search-visibility-for-banking-financial-services-brands/

Serpzilla, “Schema Markup for AI Search in 2026,” 2026. https://serpzilla.com/blog/schema-markup-ai-search/

Semrush, “AI Search Trust Signals: The Practical Audit,” 2026. https://www.semrush.com/blog/ai-search-trust-signals/

Quinnox, “Knowledge Graph in Finance Explained,” 2024. https://www.quinnox.com/blogs/knowledge-graph-in-finance/

Graphwise, “Ontologies and Knowledge Graphs in Financial Services,” 2024. https://graphwise.ai/blog/the-power-of-ontologies-and-knowledge-graphs-practical-examples-from-the-financial-industry/

AirOps, "The Silent Pipeline Killer: How Stale Content Costs You AI Citations (and Customers)" 2025.

https://www.airops.com/report/the-impact-of-stale-content-on-ai-visibility/

Product explainer

—

Feb 11, 2026

The Anchor and The ID: How Wrodium and World Can Stabilize the AI Knowledge Economy

Kaia Gao

Leanid Palhouski

—

Jan 29, 2026

Anqa - From zero to 956 users in 30 days with Generative Engine Optimization (GEO)

Arlen Kumar

Leanid Palhouski

Product explainer

—

Jan 27, 2026

From Campaigns to Claims: The New Agency Playbook for GEO

Kaia Gao

Leanid Palhouski